Magical Miles - Automatic Mileage Log and Auto Mile Tracker for Tracking Every Deduction and Expense

***OVER $5,000,000+ IN DEDUCTIONS AUTOMATICALLY LOGGED***

"If you dont remember to log miles, let Magical Miles remember for you." - iMore.com: Best Mileage Tracking Apps for iPhone

FEATURES

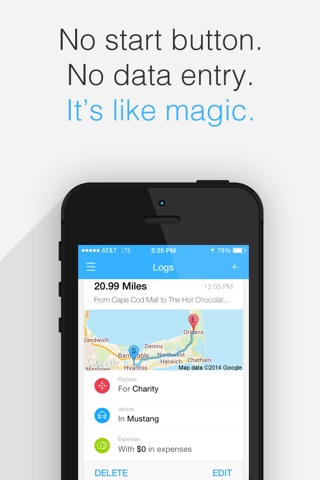

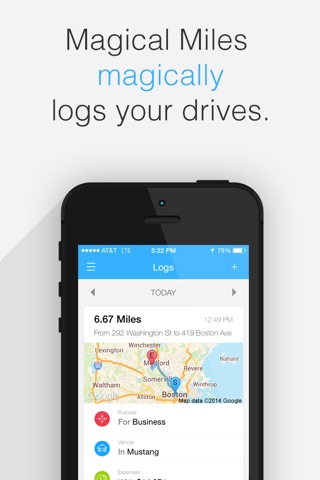

• Fully automatic mileage logging! Theres no need to remember to track your drives, because Magical Miles senses when youre driving and does it for you.

• Automatically calculated trip distances and deductions based on your actual routes driven.

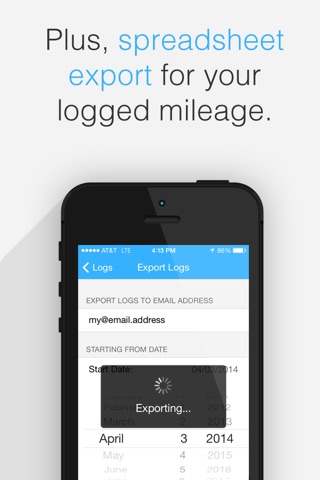

• Effortlessly export your logs as a spreadsheet to share with your accountant, your boss, or the IRS.

• Custom tax system and deduction support for international users.

• Easily enter expenses, log notes, and classify drives by purpose and vehicle.

• Quickly swipe to delete personal, non-deductible drives, or classify them as non-deductible to keep track of them.

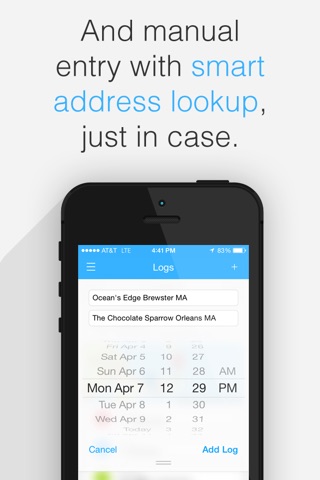

• Manual log entry with smart address searching (just type in the name of a place and itll find the address for you!), and automatic distance calculation based on driving directions so you can be confident the log is accurate.

• Automatically assign logs to a default vehicle.

• Fully supports kilometers as well as miles.

• Motion support for reduced battery usage on the iPhone 5s, 6, and 6+.

• Log up to 100 miles (160 km) completely free of charge (and when you upgrade to unlimited logging, dont forget to write it off on your taxes)!

Note: Continued use of GPS running in the background can dramatically decrease battery life. Magical Miles tries to use as little power as possible when not tracking your drives, but its recommend you have a car charger handy while driving.

WHY DO YOU NEED MAGICAL MILES?

In 2016 every mile you drive for business purposes is worth $0.54 in tax deductions. And did you know medical and charitable drives are deductible, too? By logging your deductible miles you could save yourself thousands of dollars on your taxes.

If you can write off deductible mileage, or expense mileage for work, you need this app. Everyone from small business owners to freelancers, real estate agents, salespeople, contractors, 1099 independent contractors, and more can save thousands of dollars a year without lifting a finger by automatically logging every single deductible mile they drive with Magical Miles!